50 Years!, Stocks Slow in September, and Good Causes

- Doug MacGray

- Oct 1, 2023

- 5 min read

October 1, 2023

HAPPY 50TH!: A couple of generations ago, if someone needed guidance on saving or planning for retirement, they would likely call a stockbroker, mutual fund salesperson, or insurance salesperson. While some of those salespeople might have been able to provide appropriate advice, there was no way for a consumer to know which among the many brokers and sales agents were actually capable of giving true and appropriate advice that would help them achieve their objectives. In the late 1960s, a movement began to organize and promote best practices that would establish financial planning as a true profession. Thus, in 1973, a group of 35 planners became the first recipients of the CFP® or Certified Financial Planner® mark. Today there are about 97,000 people in the U.S. who have earned that mark, two of whom work at Stonecrop Wealth Advisors.

GOVERNMENT SHUTDOWN: As I write this, another threatened government shutdown hangs in the balance. Note, this isn’t a shutdown due to a debt ceiling crisis. That is worse. If we have a shutdown on Sunday, we will not be in danger of defaulting on our debt. Social Security checks will also be delivered. Many routine governmental operations, such as food inspections, and SBA loans could stop, as could IRS audits (oh snap!). Many government workers would not be paid (but the pay is almost always made up when the shutdown is over.) Importantly (heavy sarcasm), Members of Congress will keep getting paid during a shutdown. Travel should be fine for a short while, but eventually, with no pay, TSA agents might stop showing up for work, and that would impact travel. (Breaking news….the shutdown has been averted until November!)

THE FED’S PREFERRED INFLATION GAUGE SHOWED INFLATION SLOWED IN AUGUST: The Fed’s preferred inflation gauge is the Core PCE (Personal Consumption Expenditures) Price Index. The PCE Index rose 0.4% in August, largely because of energy prices. The Core PCE excludes energy prices, and that went up only 0.1%. For June, July and August, the core PCE Index rose at a 2.2% annualized rate, very close to the Fed’s target of 2.0%. The Fed has stated that it wants to see “convincing evidence” that it has raised rates enough to sustainably lower inflation to its 2% goal. I guess they are worried that the lower inflation rate is “transitory.” (Couldn’t help myself.)

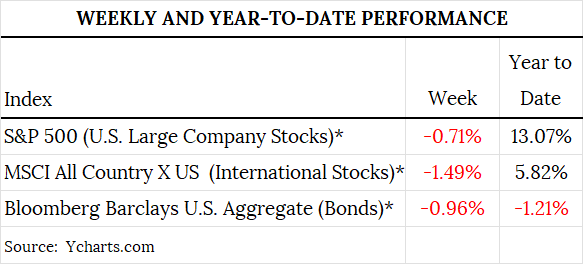

SEPTEMBER ENDS WITH A THUD: I was golfing at a charity event on Friday. Occasionally I peaked at my phone and the daily performance of various stock indices. It looked good for a while, and so I golfed in the comfort of knowing we would end the month on a positive note. Not so fast. Late in the day, most indices drooped a bit, and September closed out with the worst monthly performance of the year. The negative month is largely due to investors souring on the probability that higher interest rates will be around for a while, and simply the realization that stock prices perhaps got a little ahead of themselves. Bond prices plummeted in September as well, which is no surprise given the new prevailing wisdom on interest rates.

LONGER-TERM PERFORMANCE: Below are the annualized three-year and five-year numbers for these same indices.

HEALTHY INCREASE IN PERSONAL INCOME IN AUGUST: Personal income in the U.S. increased by 0.4% in August, according to the U.S. Bureau of Economic Analysis. If you include energy prices (especially gasoline), prices went up at the exact same rate, so it was a wash. But at least the average paycheck kept up with inflation.

RENTING IS GETTING CHEAPER: According to the ApartmentList.com, apartments across the country are 1.2% cheaper than they were one year ago. Rent fell month-over-month in September in 85 of the 100 largest cities in the U.S.

WILL CHINA’S ECONOMY TURN AROUND?: Despite recent good news, I don’t think so. Chinese factories in September reported their first expansion since the spring. Railway and flight bookings recorded a huge uptick, largely due to its National Day holiday. That is the good news. China still faces a reckoning in its real estate sector. Once its largest real estate developer, China’s Evergrande, appears on the precipice again. Trading in its stock has once again been suspended. Its director and executive chairman is now under scrutiny for suspected crimes. It has been trying to restructure. Its demise will have negative ripple effects throughout its economy. In addition, housing sales in general are declining, as are exports. We will see if this recent uptick shows any signs of sustainability.

SICK DAYS: Have you taken a sick day in the last 12 months? Employees were asked that question in a worldwide survey (ten countries) by Statista. The country with the highest amount of employees saying that have not taken one sick day in the last twelve months is South Korea at 51%. Japan came in second at 45% followed by Spain at 39%. The U.S. and Canada both came in at 23%. Coming in last was Australia at 14%.

GOT IN A GOLF DAY: Stonecrop Wealth Advisors sponsored a charity golf event that supported MARKINC Ministries and a breast cancer awareness charity, Faith Wears Pink. It was at a new course called St. Anne’s Links in Middletown, Delaware, a rapidly growing area in southern New Castle County. On one hole, if you got a hole in one, you won a trip to California and the ability to play at Pebble Beach and Spyglass. You had to take videos of your shots to verify the ball went in. I took videos of my three teammates, none of whom holed it, but all of whom had decent form. I didn’t even hit the green.

…AND SPEAKING OF CHARITY: There is a mutual fund company whose funds we have used a good bit. Annually, they conduct a survey of advisors across the nation as to how they spend their money. They share the results with us if we participate. It is very useful information as it can help us determine whether we are paying too much for a particular line item (such as marketing, technology, compensation), or paying less than most. It is useful benchmarking. One particular item that stood out for us is in the area of charitable giving. We gave 10.41 times more than the average investment advisory firm that took part in the survey. Despite that lopsided statistic, we have no plans to lower our rate of giving. But I hope our competitors begin to catch up!

Have a great week!

Our mission is to help you see the objective, find the path, and navigate past the obstacles to a more prosperous future.

President

Stonecrop Wealth Advisors, LLC

Direct | Cell | Fax

(610) 628 4545

dmacgray@stonecropadvisors.com

“You only live once, but if you do it right, once is enough.” Mae West

“Never tire of doing what is good.” II Thessalonians 3:13 (NIV)

SOURCES:

THE FED’S PREFERRED INFLATION GAUGE SHOWED INFLATION SLOWED IN AUGUST: https://www.bea.gov/news/2023/personal-income-and-outlays-august-2023 AND https://www.wsj.com/economy/consumers/consumer-spending-personal-income-inflation-august-2023-ee262c56?mod=economy_lead_pos2

HEALTHY INCREASE IN PERSONAL INCOME IN AUGUST: https://www.bea.gov/news/2023/personal-income-and-outlays-august-2023

RENTING IS GETTING CHEAPER: https://calculatedrisk.substack.com/p/asking-rents-down-12-year-over-year-fcc

GOVERNMENT SHUTDOWN: https://www.wsj.com/politics/policy/what-happens-during-a-government-shutdown-4cc29885?mod=economy_lead_story

WILL CHINA’S ECONOMY TURN AROUND?: https://www.wsj.com/world/china/chinas-economy-picks-up-steam-for-holiday-2d8b2fc?mod=economy_lead_pos1 AND https://www.msn.com/en-us/news/other/china-evergrandes-troubles-mount-as-chairman-is-suspected-of-illegal-crimes/ar-AA1hqn1b

SICK DAYS: https://www.zerohedge.com/personal-finance/how-sick-day-culture-differs-around-world

(c) 2023 A.D., Stonecrop Wealth Advisors, LLC, All Rights Reserved

*S&P 500: This is a measure of the performance of the 500 largest companies in the United States, and it a common index to track the performance of U.S. equity markets, especially the large cap markets.

*MSCI All Country World Index X US: This is a broad measure of the performance of worldwide equity markets excluding the United States.

*Bloomberg U.S. Aggregate: This is a measure of the U.S. bond markets.

Investment advisory services offered through Stonecrop Wealth Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

_edited.png)

Comments